Tax season can be a tough time for everyone getting ready to file their tax returns. Even with a basic W-2, there is a lot of additional paperwork that can go with filing. If you’re a business owner, the entire process gets that much more complex. Get organized to help tame the annual beast. I advise all my clients to get their stuff together as soon as possible. Consider this my Business Tax Preparation 101 course.

Need help getting started? Follow these 5 things you can do to make your life (and your tax preparer’s) easier:

1. Get Started Now

Allow plenty of time to find all your receipts, invoices and statements. Pull everything together into one place so that when we start to go over material, you can readily pull out the correct paperwork to keep moving. Also, schedule your appointment for preparation as early as possible. Taxes aren’t (or shouldn’t be) something you cram the night before the deadline.

2. Want to Save Money? Do the Legwork

Having a CPA or tax attorney prepare your taxes is an expensive, but necessary expense for business owners. If you want to cut costs, don’t skimp on the quality of the preparer. Instead, do as much of the prep work as possible before you hand over your material. This way you only get billed for high-value hours. That means adding up your expenses and revenues BEFORE you get to the office.

3. Ask Questions Ahead of Time

Much like adding up your receipts on your own, do research on what is considered a qualified write-off before you come to your appointment. A quick review of Business Expense Deductions on the IRS site can help. If you’re still unsure about something, call and ask your tax preparer questions ahead of time so you have all the information you need at your fingertips.

4. Former tax problems? Self-Disclose Now

I don’t like surprises. If you already owe money to the IRS, received a letter from them, or are currently under investigation, don’t try to hide this because of embarrassment. Be up front before we get started, it’ll save us both a lot of heartache (and you a lot of money) down the road. As a tax attorney, knowing you have a problem, I’d approach your current tax responsibilities much differently – and focus on the bigger problems at hand – than I would otherwise.

5. File for an Extension

I personally hate dragging out processes, but sometimes things happen. You may have an upcoming hearing, a large change in income on the horizon, or a very busy quarter preventing you from filing on time. There is no penalty for filing for an extension, IF you do it on time. If you fail to file, you could be facing hefty fines and penalties, compounded by interest.

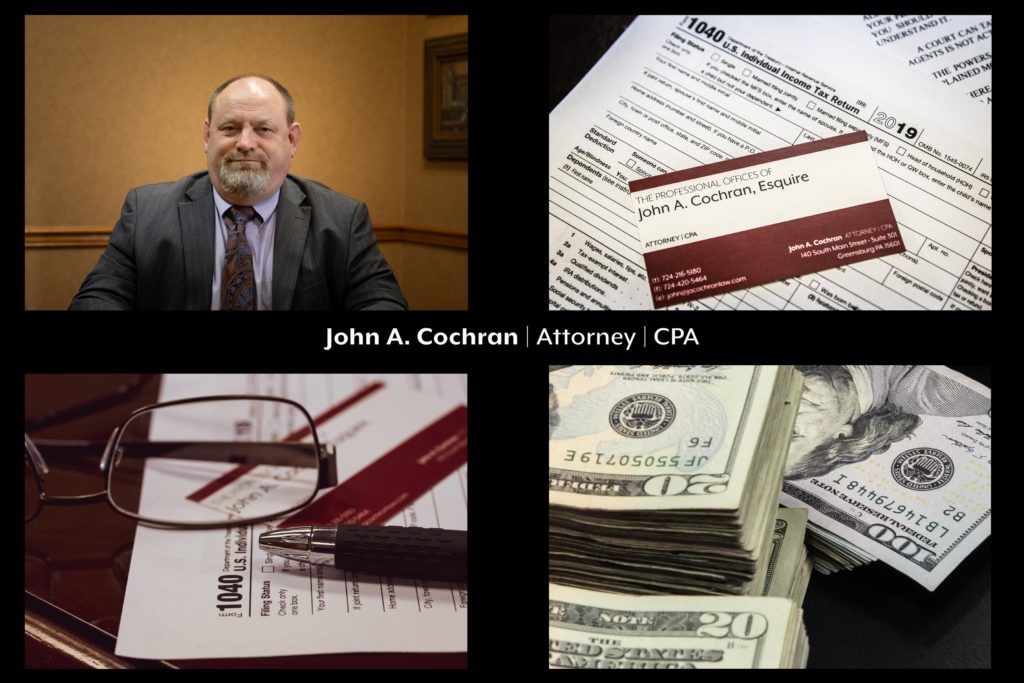

With extensive experience in tax preparation and tax law, we’ve helped our clients save thousands of dollars in federal taxes. We can help you pay the minimum amount of taxes possible while still being in compliance with federal tax law. If you have questions or would like to schedule a consultation discuss your specific needs, call our office at 724-216-5180 or use our online form.