Say you own an independent business or need someone to offer tax code or legal advice on a specific situation. You know already you need someone with more experience than your typical tax preparation consultant. But should you hire a certified public accountant (CPA) or retain a tax attorney? Who you go to is largely determined by your specific needs.

CPAs

For most tax preparation questions, a CPA serves as a logical resource. They understand complex tax situations and compliance of federal laws. A CPA has far more experience than someone at a tax preparation booth in a big box store during tax season. They have earned advanced business degrees. They’ve passed intensive CPA exams. And they complete 80 hours of continuing education every two years. While a CPA is more expensive than the tax preparation consultant you see annually, you build a professional relationship with them. And they will know your business and understand how fluctuations or new tax clauses can affect you and your long-term financial plans. For many, this ongoing relationship provides all the tax support they need.

Tax Attorneys

Tax attorneys, on the other hand, are legal professionals with law degrees specializing in tax law. A tax attorney has matriculated from a law school and sat for the bar exam. Their expertise is in tax controversy and dispute resolution. Tax attorneys help with especially complex personal or business tax matters. They are invaluable if you have serious tax problems involving negotiations with the IRS or if you are implicated in tax fraud. Tax attorney training prepares them to defend their clients against adverse tax actions. They also will represent their clients during IRS proceedings.

An important point to note: while both a CPA and tax attorney will look out for your best interests with the IRS, only a tax attorney is bound by attorney-client privilege. Nothing shared with your tax attorney will be admissible against you during negotiations on your behalf without your consent. A CPA will need to disclose information to regulatory bodies outside of the IRS, in private civil matters, or in criminal tax matters.

How we can help

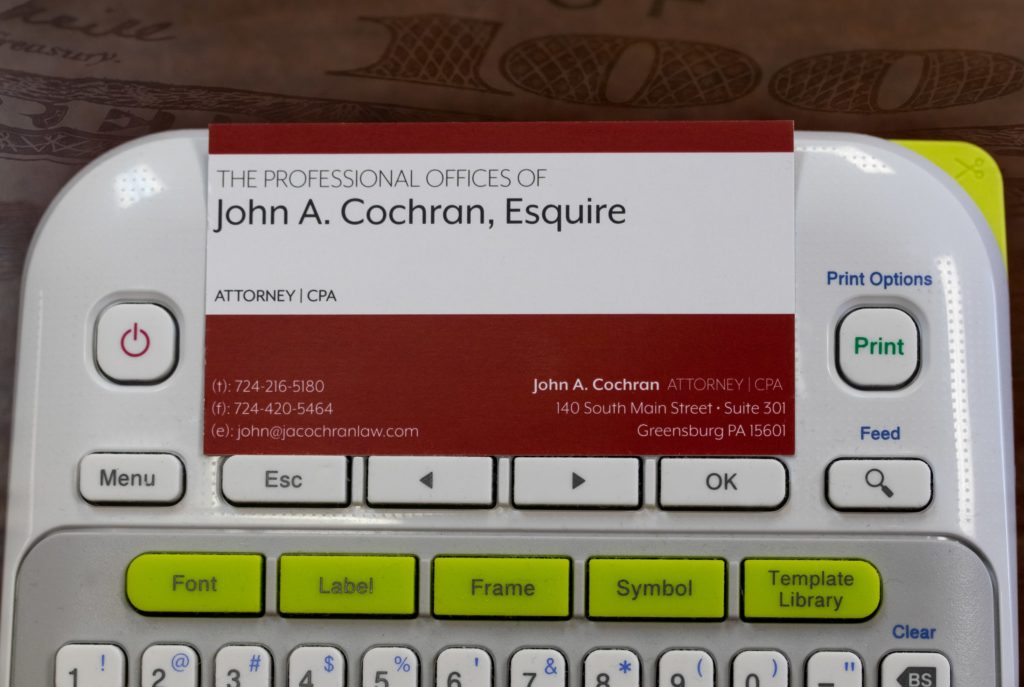

With extensive experience in complex tax matters, I focus on tax compliance and minimization and resolution of tax controversies. Although I hold a J.D and a master’s degree in taxation, for many years I worked as a CPA. This allows me to interact more closely with accountants and financial professionals while offering insights that only an attorney can provide. I provide an enhanced level of legal advice, right in Greensburg, at lower rates than firms in downtown Pittsburgh. My combination of experience provides a one-stop shop for my clients on everything they need to survive this tax season and ghosts from fiscal years past.

Interested in learning more? To schedule a free consultation, call our office at 724-216-5180 or use our online form.