When you have an estate plan you protect your family and your wealth. Do you have an estate plan yet? If not, how do you plan to ensure your assets end up in the right hands?

What is an Estate Plan?

An estate plan outlines how to manage and distribute a person’s assets and property after their death or incapacity. This set of legal documents and strategies can include a will, trust, power of attorney, and other documents.

Together, these materials provide guidance on how to carry out a person’s wishes while protecting their family and loved ones. They do this by distributing the person’s assets according to their wishes, rather than by state law.

How Do Estate Plans Protect Your Family?

Estate plans protect an individual’s family and loved ones in a variety of ways, some less obvious than others.

Most obviously, a will allows a person to specify who will inherit their property and assets, and in what proportion. Trusts can protect assets for the benefit of family members, like children or grandchildren, and to provide for their financial needs.

But they can help provide for an individual’s family and loved ones prior to their death. Say a person becomes incapacitated, estate plans can provide for their care through powers of attorney and health care directives. They appoint someone to make financial and medical decisions on someone’s behalf if they are unable to do so themselves.

This helps to prevent disputes and ensure a person’s wishes are respected. It also protects their wealth from misuse by making it harder for anyone squander it.

Additionally, estate plans can help to minimize taxes and legal expenses, which reduces the burden on a person’s family. Further, in certain circumstances they help the estate avoid the time-consuming and expensive processes in probate court.

How Do Estate Plans Protect Your Wealth?

Again, estate plans can also protect a person’s wealth by minimizing taxes and legal expenses. Trusts, for example, minimize estate taxes and avoid the probate process.

In the event an individual becomes incapacitated, estate plans can provide for the continuity of their business or professional practice. Business succession planning can help to ensure that the business continues to operate smoothly, which also protects that person’s wealth.

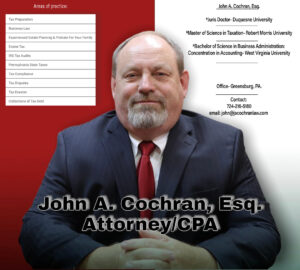

Worried that you haven’t protected your family and wealth with a proper estate plan? Relax! Our estate planning professionals can help you create a plan that respects your wishes and protects your loved ones and assets. We work with people from all walks of life and income levels. Whether you’re of modest means or have extensive asset holds, you can protect your interests. We’ll help you put in place the documents and legal instruments that can help you achieve your goals.

To learn how, call us 724-216-5180 or contact us online to schedule a consultation.