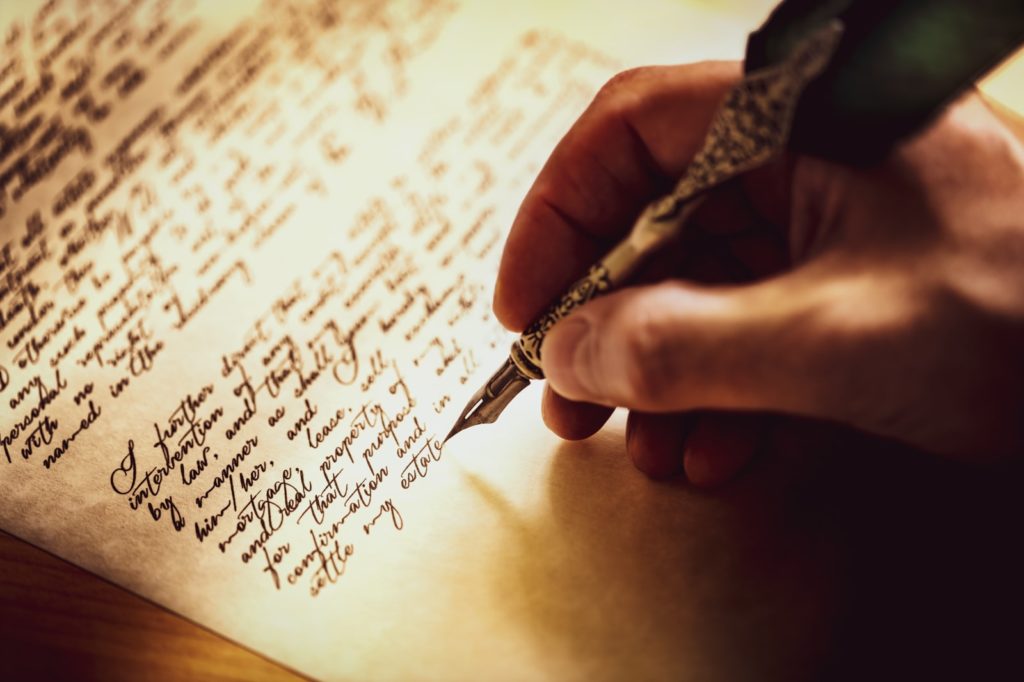

Even though it’s nearly 2020, handwritten wills do still exist. And yes, they are legal in a handful of states, including Pennsylvania; however, there are stipulations and special care must be taken to confirm their validity. While this isn’t the recommended way of making final preparations for assets after death, sometimes a handwritten will is better than no will at all.

For any will (typed or handwritten) to be considered valid, or the person whose assets will be distributed upon death, or “the testator,” must be at least 18 years of age and be of sound mind. This means the person needs to understand what they are signing and what possessions they will be bequeathing.

The actual document itself, regardless of its contents, needs to in some way state that it is to serve as a last will and testament for the person. It just won’t cut it to hand over a note to the courts that simply states: “hey friend, I’m giving you all my things.”

Creating a handwritten will without the assistance of an experienced estate attorney can be risky business for proving its validity in court as well as assuring your assets are distributed according to your wishes. This is especially so if the last will and testament is for someone who has children that are minors, has remarried or is part owner in a business venture. Owning assets in multiple states or countries increases the complexity.

In some states, handwritten wills must be made within the state, have two independent witnesses confirm the signature, and the document must be notarized. Unsurprisingly, named beneficiaries do not count as independent witnesses.

Pennsylvania is one of a handful of states that also permits an unwitnessed will to be admissible in probate. An unwitnessed will, or holographic will, only needs to be signed and dated by the testator at the end. It is also the easiest will to challenge in court. And while a witness may not be necessary at the time of signing to make the will valid, at least two independent witnesses must attest in court that the will indeed is signed by the testator.

Whenever possible it is best practice to avoid utilizing handwritten or holographic wills. As part of the services offered in our offices, we have joined testators at home, in hospice or in other settings outside our offices to create and validate wills. These include times when the testator is too injured or too ill to write and sign a will. However, if left with a handwritten or holographic will, having an attorney experienced in handwritten wills and the specific details necessary for it to be admissible in court can make the difference between a will being accepted or declared invalid.

If you have questions about a loved one’s handwritten will or need help in drafting a valid will, contact our office at 724-216-5180 or use our online form.