A strange thing happened as part of the global pandemic and economic crises. Many people, especially if laid off or furloughed, are having “COVID epiphanies.” No longer interested in working for someone else, they’ve decided to go into business for themselves. Congratulations if you’re one of them! You may only plan to run a part-time business as a side hustle for now. However, there are many considerations when setting up a business.

No two businesses are the same. I encourage you reach out to an experienced business attorney before making any decisions. Different structures offer different sets of pros and cons. Below is a very brief description of a few areas to consider.

Ease of Establishing

The size and structure you select determines how easily a business becomes a legal entity. Usually businesses start small, helping guide which structures to consider.

Sole proprietorship’s simple business structure offers easy entry into owning a business, making it the most common small business structure. The sole prop basically acts as an extension of the person.

Partnerships operate much the same way as sole props with owners sharing responsibility.

Limited liability corporations (LLCs) require a bit more work to set up. But they minimize risk while offering flexible management. Most small businesses fall into these categories.

However, structures also exist for larger entities, including Chapter C and Subchapter S corporations. Here, shareholders exchange money, property, or both for the corporation’s capital stock.

Tax Implications

Tax implications may hold more overall weight than how hard it is to form an organization.

Owned and operated by one person, the sole prop takes total responsibility for the business’s debt and taxes. LLCs may offer lower risks with less complex taxes than corporations. A C corporation is separate, paying taxes and passing on profits to shareholders.

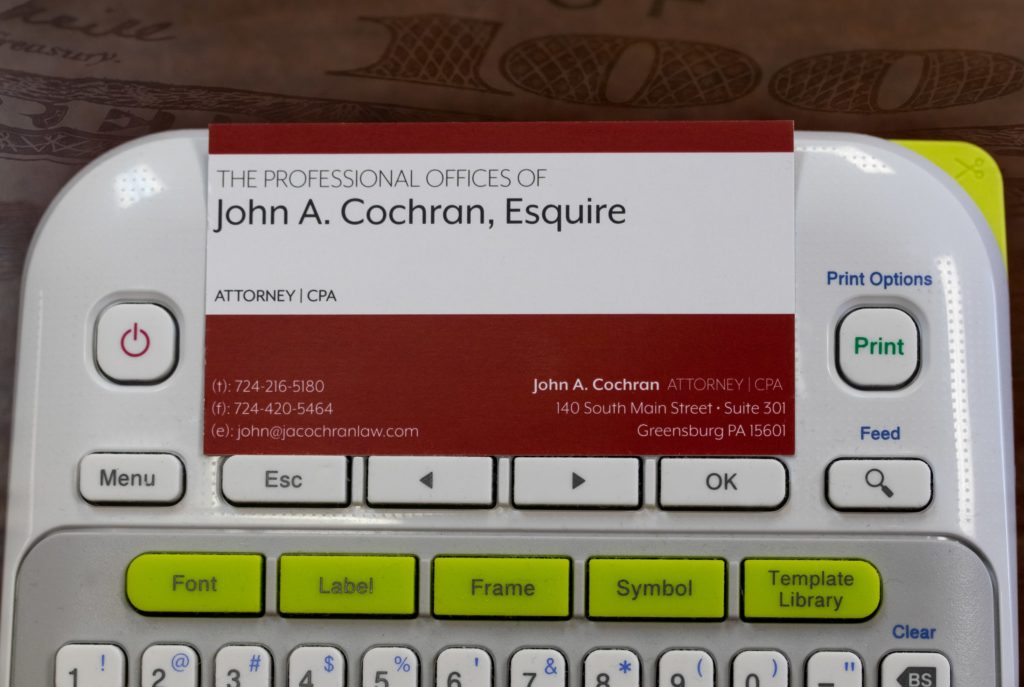

For more than 35 years, we have guided business owners through decisions involving nearly every type of business. Our past clients include sole props, partners, LLCs, and Chapter C and Subchapter S corporations. Each decision comes from many smaller choices. These choices include business control, asset protection, tax rates, and other matters.

Interested in learning how to turn your COVID epiphany into a proper business? We can walk through considerations when setting up a business with you. Call John A. Cochran, Esquire, in Greensburg at 724-216-0704 or use our online form.