What do you think about when someone talks about creating an estate plans? If you’re like most people, you assume that means they have a will. Full stop. But did you know that’s only part of the equation? Below we’ve listed five steps for creating an estate plan.

1. Wills

Yes, wills serve as the backbone of an estate plan. Probating a will usually lacks the Hollywood drama of fainting, crying, and shouting in an attorney’s office during the reading. But without one, relatives automatically become heirs, even if you’d rather they not. Don’t want your mom to gain possession of your prized comic book collection? Ensure you have a valid will that gives them to your comic-con buddy.

2. Beneficiaries

More than just who gets what in your will, you also need to name beneficiaries on all life insurance, retirement plans, and other assets. Spouses with joint ownership of assets – like a house – will automatically inherit the asset, so long as the deed reflects this. Also, revisit these beneficiaries periodically, especially after a large life change. I hate explaining to a deceased’s wife that the ex-wife inherits the insurance money because he never updated his policy beneficiaries.

3. Memorandums or Letters

Not everything will be captured in a will. Some sentiments require additional explanation. For example, some people want to dictate every aspect of their funeral, including what songs to play during the service. We recommend these individuals write everything down in a document colloquially called a Memorandum of Death. Maybe that sounds creepy, but if you feel strongly about NOT playing Amazing Grace at your funeral, better record it. This also works for making sure the right people receive sentimental items with an explanation of why.

4. Power of Attorney

No one wants to think about losing their facilities and not being able to make their own decisions. But if you plan to live a long life, the odds favor those with a durable power of attorney (POA). With a POA, a trusted individual can advocate for your financial affairs. They will act on your behalf to pay bills and disperse your funds according to your wishes. PS: it’s not always a relative who serves in this role.

5. Declutter your files

Grieving loved ones don’t need additional obstacles to closing a deceased’s affairs. Nobody wants to sift through losing lottery tickets, old magazines, and canceled checks to desperate need to find your estate plan and other important paperwork necessary to file for probate in the courts. Don’t be “that guy” that keeps everything in a grocery bag in the back of the hall closet. Organize your stuff.

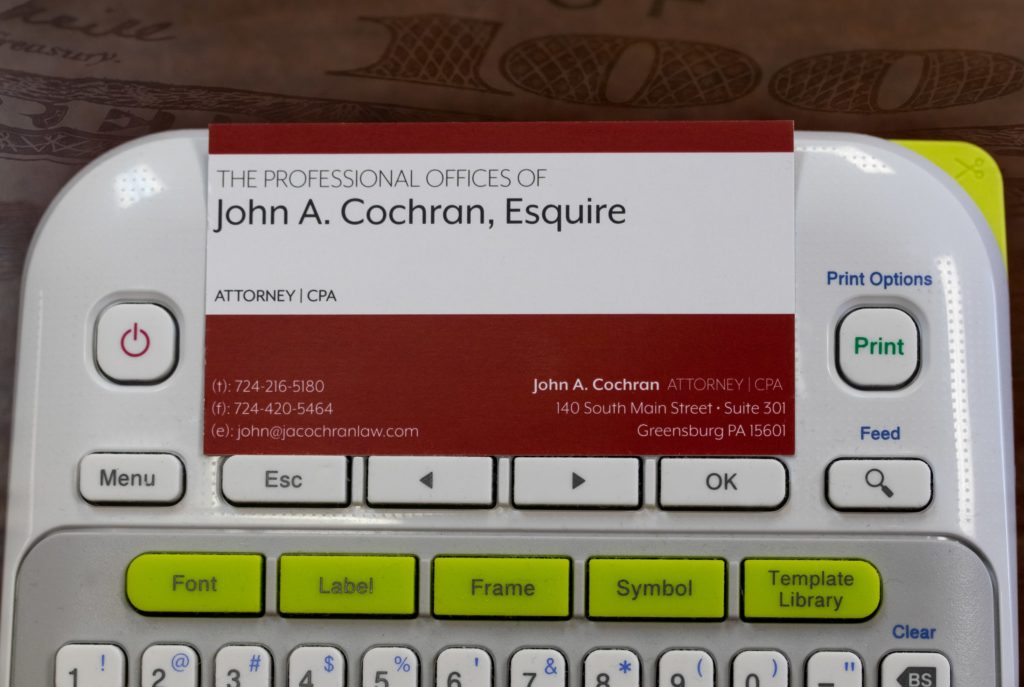

Ready to make sure your estate plan needs your needs? Relax! Call our office at 724-216-5180 or complete the online form to schedule a free consultation.